More than a million Americans who had died received COVID-19 stimulus payments totaling $1.4 billion, a government watchdog said in a report to Congress released Thursday.

The finding is part of a sweeping review of the federal government’s response to the COVID-19 pandemic by the Government Accountability Office, an independent nonpartisan congressional agency. The report paints a clearer picture of what critics called a muddled rollout by the Internal Revenue Service and the Treasury Department of more than 160 million payments worth $269 billion.

Congress passed a massive $2 trillion stimulus package, called the CARES Act, in March to soften the economic blow of the coronavirus pandemic for American workers and businesses.

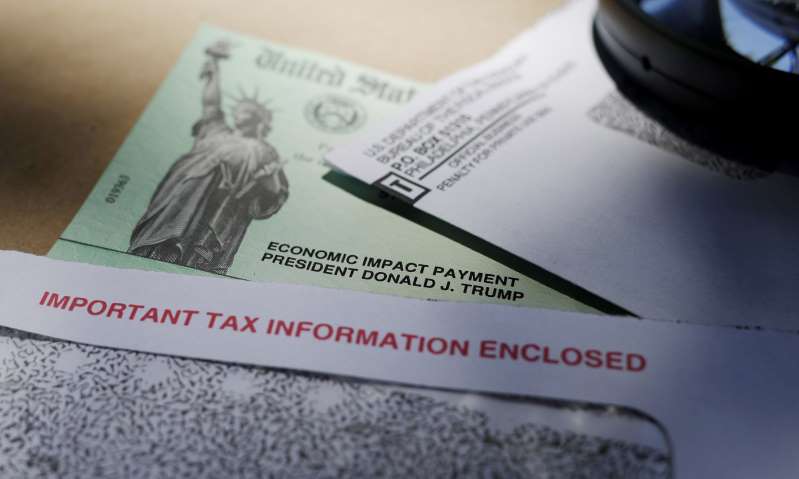

Eligible Americans received checks, called Economic Impact Payments, based on their 2018 or 2019 income tax returns, or by filling out a simple tax return. Individuals making up to $75,000 a year received checks for $1,200 and couples making up to $150,000 and filing a joint tax return received $2,400, with an additional $500 per qualifying child. The payments decreased for those making more than $75,000, with an income cap of $99,000 per individual or $198,000 for couples.

GAO’s report said Treasury officials said that, to meet the CARES Act’s mandate to deliver payments as “rapidly as possible,” Treasury and the IRS sent out the first three batches of payments using previous operational policies and procedures for stimulus payments “which did not include using [Social Security Administration] death records as a filter to halt payments to decedents.”

GAO also reported that IRS’ legal counsel had “determined that the IRS did not have the legal authority to deny payments to those who filed a return for 2019, even if they were deceased at the time of payment,” and had advised applying the same rules to recipients who had filed a 2018 return.

There was an initial backlog when the IRS began sending the first round of payments and relatives of dead Americans all over the country said they received coronavirus relief payments from the on behalf of the loved one. Families initially believed they could keep the payments, but the IRS updated its guidance in May to say that people who have died do not qualify for the coronavirus relief payments and “should be returned to the IRS.”

The GAO said in its report that the IRS does not currently have a plan in place to notify ineligible recipients, which includes the relatives of the almost 1.1 million deceased Americans who received a payment as of April 30. The watchdog agency said the IRS should consider “cost-effective options” for notifying ineligible recipients on how to return payments, which IRS agreed to do.

The IRS and Treasury didn’t immediately provide comment to NBC News.

President Donald Trump indicated earlier this week that he’s open to another round of “very generous” stimulus payments as the U.S. economy continues to reel from the coronavirus pandemic.

Last month, the Democratic-led House passed the $3 trillion HEROES Act that included another round of direct payments, but the Republican-controlled Senate has yet to vote on the bill as leaders say they want to wait to see what, if any, additional aid is needed.

The GAO report, COVID-19 Opportunities to Improve Federal Response and Recovery Efforts, reviewed actions by multiple federal agencies to address the pandemic, from reporting national data on viral testing to distributing critical medical supplies to disbursing relief funds and loans.

GAO also faulted the U.S. Small Business Administration for its handling of the Paycheck Protection Program, or PPP, which was created under the act to provide direct relief to small businesses amid the coronavirus pandemic.

The program has faced criticism for providing aid to unintended recipients, such as large publicly traded companies. Many businesses around the country have also complained that they either could not tap into loans or did not receive adequate funds to keep their businesses afloat and their employees on the payroll.

The GAO said the Small Business Administration is stonewalling collection of data to show detailed information regarding loan recipients.

SBA has signaled that they will provide the watchdog agency with the PPP data, but first officials need to discuss shielding proprietary and personal privacy information of recipients.

MSN